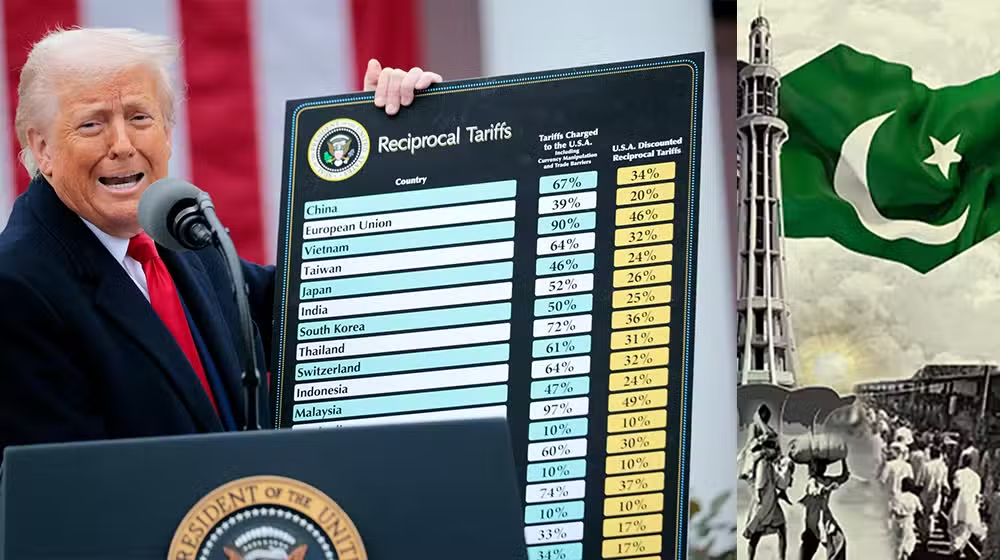

In the wake of the escalating global tariff war, Pakistan stands to gain substantial economic relief and save over $2 billion in import bill due to a significant drop in commodity prices, particularly crude oil, RLNG, and coal.

In the aftermath of the tariff war initiated by the US and retaliated by other nations, the Bloomberg commodity index has declined by 8 percent in the last three sessions. Within this, crude oil prices (Brent) and Richards Bay coal futures (April) are down by 14.3 percent to US$64.2 per barrel and 6.1 percent to US$88.5 per ton, respectively.

Binance Founder Changpeng Zhao Joins Pakistan Crypto Council as Strategic Advisor

Topline noted that the falling commodity prices will impact Pakistan’s macroeconomic indicators, including external accounts, primarily the current account, inflation, and fiscal accounts, among others. For instance, if oil prices decline by US$10 per barrel, this would reduce the oil-related import bill (including RLNG) by US$2-2.1 billion. In addition to oil, Pakistan can also save US$250-300 million annually from coal, LPG, and palm oil if lower levels of prices persist. Oil prices also affect inflation directly, and with a US$10 per barrel decline in oil, inflation would be directly impacted by 20 basis points, assuming the benefit is passed on to consumers. The details are outlined below:

Pakistan Imports 20 million tons of crude and refined oil annually: During FY24, Pakistan imported 9 million tons of crude and 10.3 million tons of refined oil (HSD, petrol, etc.), translating into a total of approximately 145 million barrels of equivalent oil. Every US$1 per barrel decline in oil prices will reduce the import bill by US$145-150 million, and every US$10 per barrel decline will result in savings of US$1.5 billion on the petroleum oil front.

Pakistan Imports US$4 billion of RLNG annually: Alongside oil imports, Pakistan also imports RLNG worth US$4 billion, or 400 million MMBtu, annually. RLNG

prices are linked to oil prices, and a change of US$1 to US$10 per barrel can save US$60 million to US$600 million in RLNG imports annually.

Pakistan Imports 10 million tons of coal annually: Pakistan imports coal worth US$1-1.2 billion annually. With every change of US$10 per ton in coal prices, the coal import bill will decrease by US$100 million.

These three commodities can save US$2-2.1 billion of Pakistan’s imports, which accounts for 3.5-4 percent of Pakistan’s total imports.

7901 4th Street North no 22902, ST Petersburg FL 33702, United States.

7901 4th Street North no 22902, ST Petersburg FL 33702, United States. Unit 3A 34-3, Hatton Garden Holborn, London, EC1N 8DX, United Kingdom.

Unit 3A 34-3, Hatton Garden Holborn, London, EC1N 8DX, United Kingdom. Suite # 903-A1, 9th Floor, Al Mustafa Towers, F10/3, Islamabad, Pakistan.

Suite # 903-A1, 9th Floor, Al Mustafa Towers, F10/3, Islamabad, Pakistan.